MANITOWOC, Wis. — Orion Energy Systems, Inc. (Orion Lighting), is a provider of LED lighting systems and turnkey project implementation including installation and commissioning of fixtures, controls and IoT systems, ongoing system maintenance and program management, helping customers to digitize their business and reduce their carbon footprint. Orion reported results for its FY 2021 first quarter (Q1’21) ended June 30, 2020.

MANITOWOC, Wis. — Orion Energy Systems, Inc. (Orion Lighting), is a provider of LED lighting systems and turnkey project implementation including installation and commissioning of fixtures, controls and IoT systems, ongoing system maintenance and program management, helping customers to digitize their business and reduce their carbon footprint. Orion reported results for its FY 2021 first quarter (Q1’21) ended June 30, 2020.

CEO Commentary

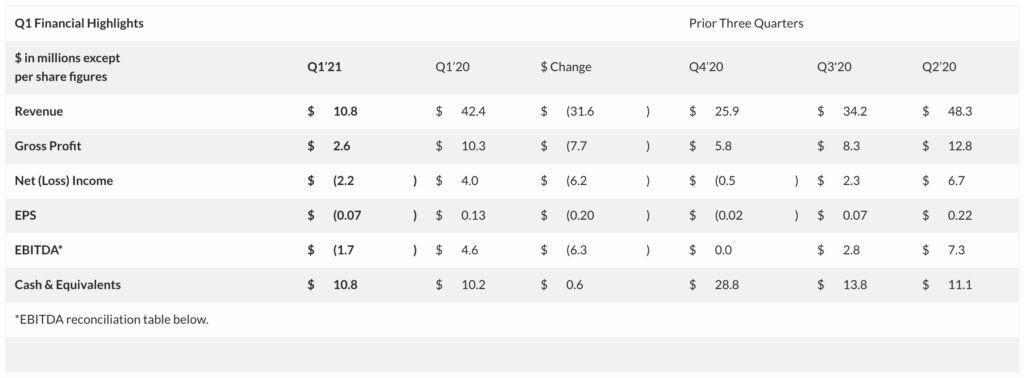

Mike Altschaefl, Orion’s CEO and Board Chair, commented, “As expected, Q1’21 was very challenging as the COVID-19 pandemic temporarily halted work on most of our large customer projects, resulting in total revenue of $10.8M in the period. Despite a difficult environment, Orion improved its gross profit percentage in Q1’21 compared to the year-ago period and Q4’20. Further, the proactive steps we took in Q4’20 to reduce overhead and operating costs contributed to holding our Q1’21 net loss to just ($2.2M), or ($1.7M) on an EBITDA basis. Considering the speed and severity of COVID-19 related project delays, I am very proud of our team’s operating discipline during this period and the resulting strength of our financial position to support our business as markets are reopening.

“We did have a few revenue bright spots during Q1’21, including $3.6M of revenue for a new construction project for a global online retailer. We expect revenue of approximately $2M from this customer in Q2’21, with the possibility of additional business going forward.

“Orion’s focus on large national accounts continues to be the right strategy to drive our business long term, as demonstrated by our growing base of such customers. Businesses of this scale and sophistication are best positioned to appreciate the benefits of our turnkey design-build-install LED lighting and controls capabilities and to fund energy saving, productivity enhancing upgrades to their facilities. While the COVID-19 pandemic did suspend many large customer projects, most projects are now progressing toward relaunching over the next few quarters. We are now pivoting our business and resources to prepare for the anticipated rebound toward more normalized business activity levels, and we are feeling much more optimistic about the balance of this fiscal year than we were two months ago.”

FY 2021 Outlook

Given improving visibility on the timing and scale of new and existing major customer projects, Orion now believes it is on track to achieve Q2’21 revenue of at least $25M and a sequential revenue improvement in Q3’21. As a result, Orion now expects to return to profitability in both Q2’21 and Q3’21. This updated outlook reflects a range of recent customer dialogues and a faster than anticipated rebound in business. This outlook assumes no material negative change in COVID-19 related project impacts and is supported by the following factors:

Retrofit installations restarted this week on the turnkey design-build-install LED lighting system and controls retrofit project for a major national account that has recently been Orion’s largest customer. While Orion had previously expected installations to restart in Q4’21, it now expects to complete retrofits for approximately 225 of this customer’s remaining 600 stores during Q2’21 and Q3’21, with installations in the remaining 375 stores currently estimated to begin in Q4’21 and to be completed in FY 2022. Through March 31, 2020, Orion had completed approximately 880 locations and provided other products and services to this customer, resulting in total revenue of approximately $125M.

Orion has entered into initial product and installation services contracts with a new customer, a major global logistics company. Several initial facility projects are expected to commence in Q2’21. This new customer is anticipated to be a significant source of revenue over time; however, it will be implemented on a project-by-project basis, rather than larger-scale multi-site commitments, thereby limiting visibility on the timing of future contributions.

Orion also recently added a large specialty retailer as a customer and will provide turnkey LED lighting retrofit solutions for its nationwide chain of stores. The project is currently slated to commence in Q3’21 and is expected to provide additional opportunities in FY 2022.

Orion anticipates a slow but steady rebound in activity from its distribution and energy service company (ESCO) channels as more and more markets reopen and more businesses can proceed with retrofit and new construction projects.

Orion is beginning to see additional opportunities with long-standing public sector customers, including the military, the Veterans Administration and the U.S. Postal Service, with one project commencing in Q2’21.

Several of Orion’s new product launches that deliver superior quality and energy efficiency at very attractive pricing are being well received by customers and distributors and are expected to play an important role in driving sales in Orion’s three historical go to market channels.

Orion also continues to believe it is well positioned for FY 2022, with a business outlook that could return its financial results to the levels achieved in FY 2020. Orion delivered record revenue of $151M and net income of $12.5M, or $0.40 per diluted share, in FY 2020. Orion cautions investors that this outlook commentary involves uncertainty related to the COVID-19 pandemic and related business and economic impacts.

Financial Results

Orion’s Q1’21 revenue fell to $10.8M, as compared to $42.4M in Q1’20, as both product and service revenue were negatively impacted by project suspensions and delays related to the COVID-19 pandemic, compared to the year ago period, which included significant LED retrofit activity for a major national account project, which resumed in Q2’21. Q1’21 product revenue decreased to $9.7M from $32.3M in Q1’20 and service revenue decreased to $1.1M from $10.0M.

Gross profit percentage improved to 24.4% in Q1’21 compared to 24.3% in Q1’20 and 22.3% in Q4’20. Gross profit percentage was positively impacted by higher margins on certain products during the period, offset by the impact of fixed manufacturing costs on lower plant volumes.

Total operating expenses decreased 23.6% to $4.7M in Q1’21 compared to $6.1M in Q1’20, and $6.1M in Q4’20. The decrease primarily reflected proactive steps taken to reduce overhead and operating costs in line with lower revenue, which reductions were substantially implemented by the start of Q1’21.

Principally due to lower revenue in the period, Orion reported a Q1’21 net loss of ($2.2M), or ($0.07) per basic share, versus net income of $4.0M, or $0.13 per diluted share, in Q1’20. Orion had an EBITDA loss of ($1.7M) in Q1’21, compared to positive EBITDA of $4.6M in Q1’20.

Cash Flow & Balance Sheet

Orion used $7.7M of cash in operating activities in Q1’21 as compared to generating $2.0M from operating activities in Q1’20. The difference was due to the net loss in Q1’21 versus a net profit in Q1’20, as well as working capital investments to support an anticipated ramp in business volume for the remainder of FY 2021 versus the Q1’21 level. Orion also used $10.0M of cash to pay down its revolving credit facility, as both the business and lending environment have improved significantly since its March 31, 2020 year-end.

As of June 30, 2020, Orion had $10.8M in cash and cash equivalents, as compared to $10.2M at June 30, 2019, and networking capital was $16.9M as compared to $17.9M at the close of Q1’20. Orion had $6.5M of funds available to borrow on its revolving credit facility as of June 30, 2020.

Tagged with lightED, Orion Energy Systems