Signify reports second-quarter sales of EUR 1.5 billion, operational profitability of 9.0% and free cash flow of EUR 121 million

Second quarter 2019

- Signify’s installed base of connected light points increased from 47 million in Q1 19 to 50 million in Q2 19

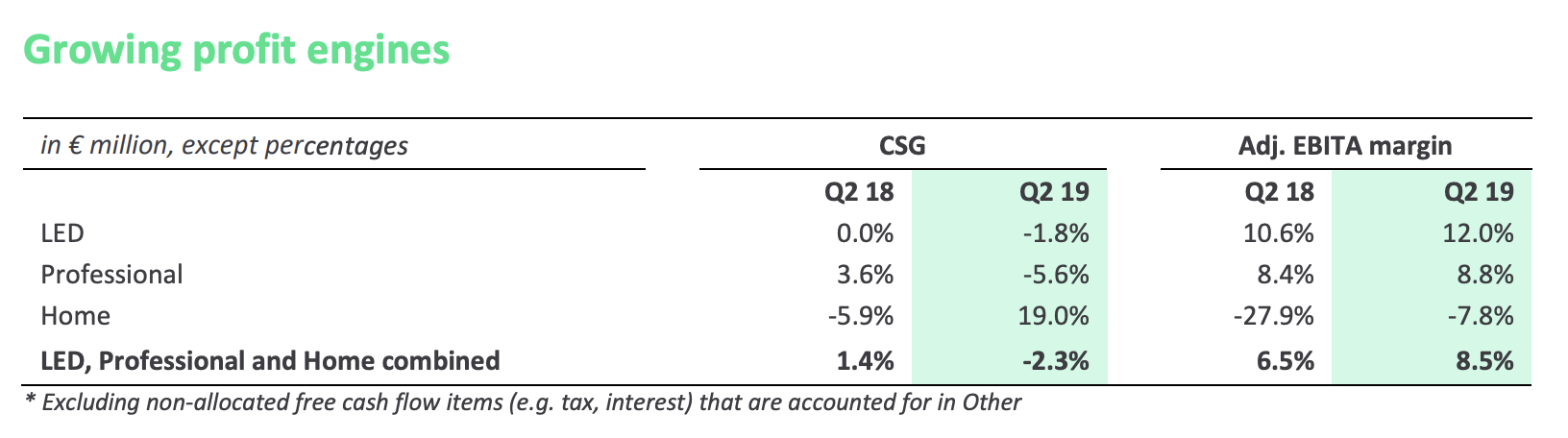

- CSG growing profit engines -2.3%; CSG total Signify -6.1%

- LED-based comparable sales grew by 0.2% to 77% of sales (Q2 18: 70%)

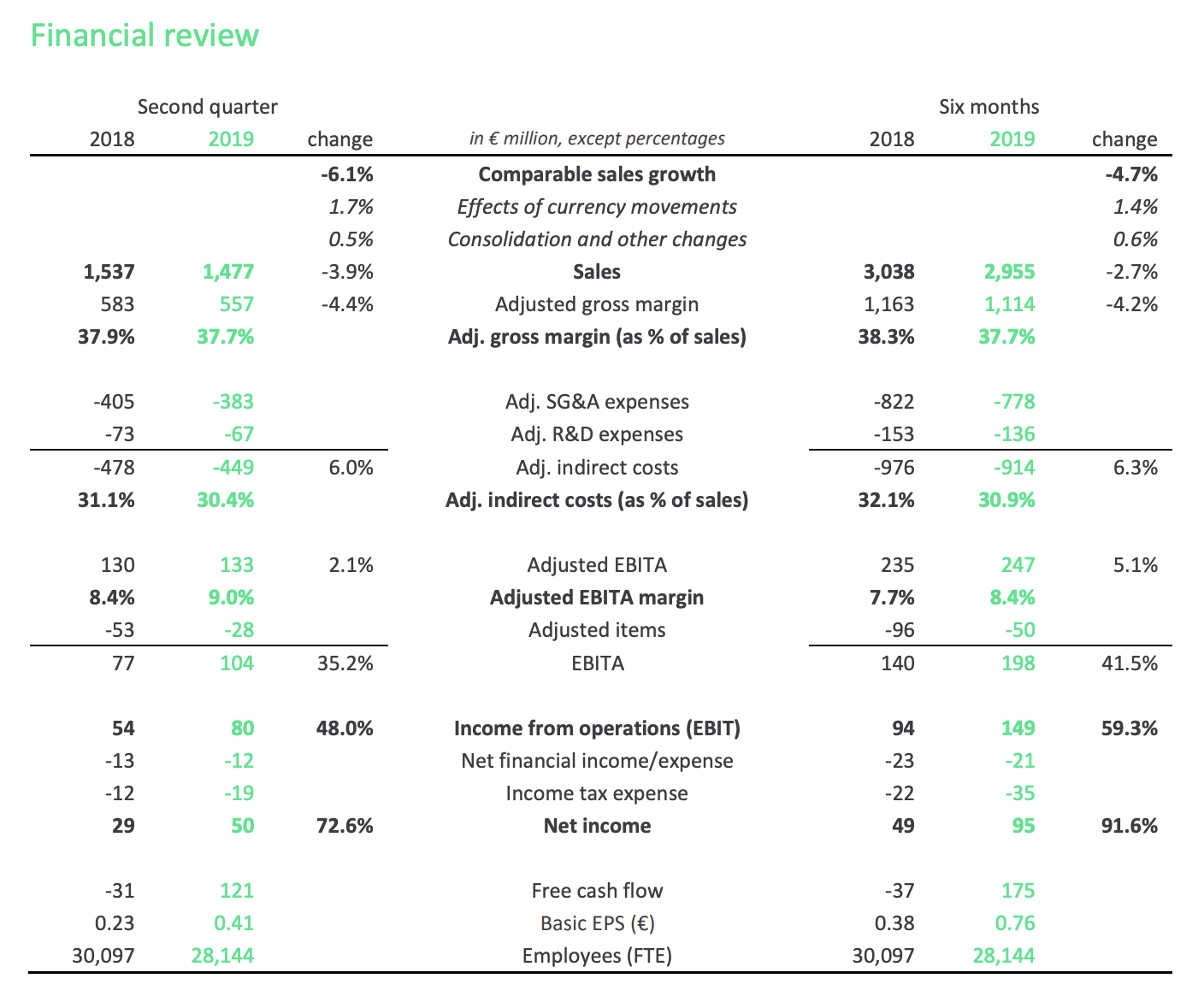

- Adj. indirect costs down EUR 37 million on a currency comparable basis, a reduction of 8%, or 60 bps of sales

- Adj. EBITA margin improved by 60 bps to 9.0%, including currency impact of +20 bps

- Net income improved by 73% to EUR 50 million (Q2 18: EUR 29 million)

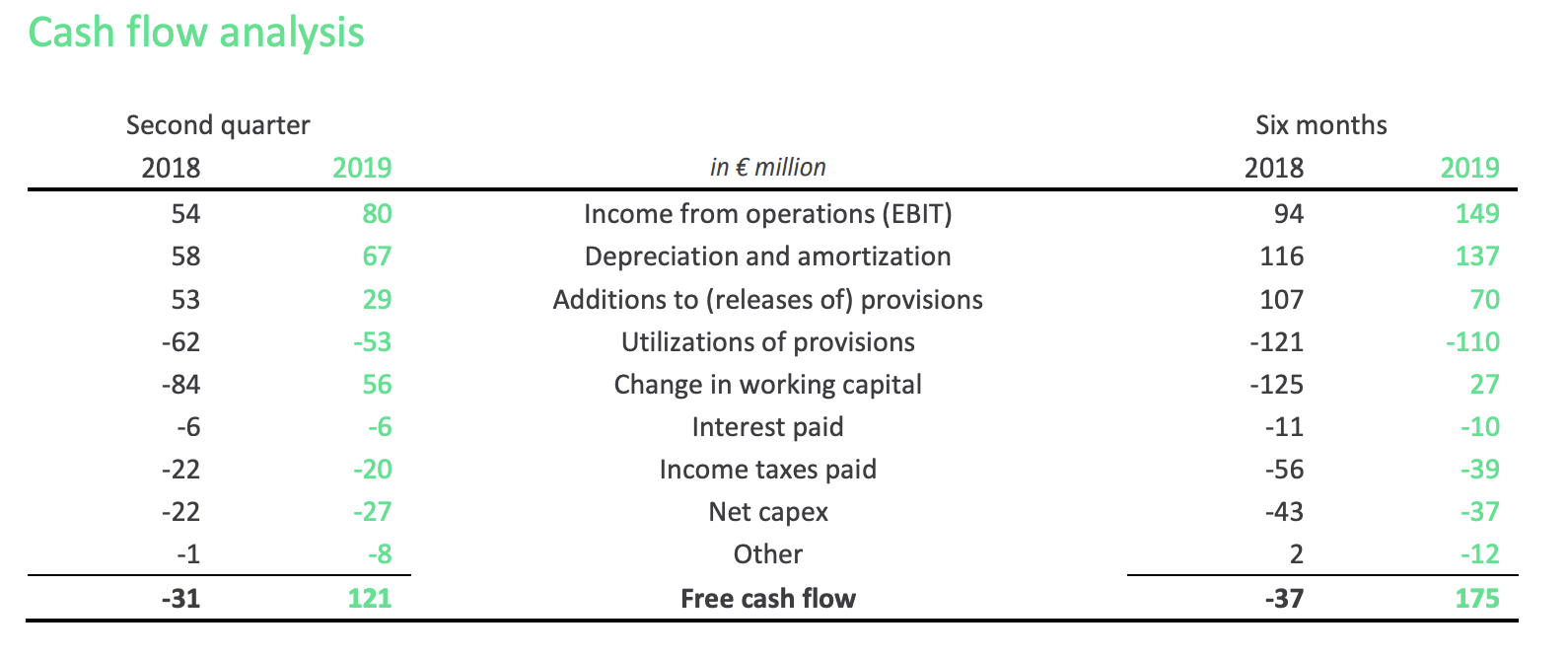

- Free cash flow amounted to EUR 121 million (Q2 18: EUR -31 million), mainly driven by higher income and phasing of payables and receivables

Half year 2019

- CSG growing profit engines -0.7%; CSG total Signify -4.7%

- LED-based comparable sales grew by 1.9% to 76% of sales (H1 18: 69%)

- Adj. indirect costs down EUR 77 million on a currency comparable basis, a reduction of 8%, or 120 bps of sales

- Adj. EBITA margin improved by 70 bps to 8.4%, despite currency impact of -60 bps

- Net income improved to EUR 95 million (H1 18: EUR 49 million)

- Free cash flow increased to EUR 175 million (H1 18: EUR -37 million)

Eindhoven, the Netherlands – Signify (Euronext: LIGHT), the world leader in lighting, has announced the company’s 2019 second-quarter results. “We are satisfied with the ongoing improvement in the operational profitability and cash generation of our businesses in the second quarter. Sales declined mainly due to economic headwinds in Europe and non-recurring country-specific developments in growth markets,” said CEO Eric Rondolat. “While market conditions remain challenging, the solid momentum in our growth platforms, our relentless focus on operational efficiencies and our strong free cash flow profile position us well for the future.”

We confirm our outlook that in 2019 our growing profit engines (LED, Professional and Home combined) are expected to deliver a comparable sales growth in the range of 2% to 5%. Our cash engine, Lamps, is expected to decline at a slower pace than the market, in the range of -21% to -24% on a comparable basis. For total Signify, we aim to reach an Adjusted EBITA margin in 2019 within the range of 11% to 13% set at the time of the IPO in May 2016. In 2019, we expect free cash flow, excluding the positive impact from IFRS 16, to be above 5% of sales.

Second quarter

Sales amounted to EUR 1,477 million. Adjusted for 1.7% positive currency effects, comparable sales decreased by 6.1%, with LED-based sales increasing by 0.2% and now accounting for 77% of total sales. The adjusted gross margin declined by 20 bps to 37.7% due to lower sales volumes and price erosion, largely offset by ongoing procurement savings. Adjusted indirect costs decreased by EUR 29 million, or 70 bps as a percentage of sales, as a result of our ongoing cost reduction initiatives. Adjusted EBITA amounted to EUR 133 million compared with EUR 130 million in the same period last year. The Adjusted EBITA margin improved by 60 bps to 9.0%, despite a sales decline, and includes a currency impact of +20 bps. Total restructuring costs were EUR 14 million and other incidentals were also EUR 14 million.

Net income increased from EUR 29 million last year to EUR 50 million in Q2 19, mainly as a result of better operational profitability and lower restructuring costs. Free cash flow, which included a positive impact of EUR 17 million related to IFRS 16, amounted to EUR 121 million, mainly driven by higher income and the phasing of payables and receivables. The effect of phasing is estimated to represent around half of the free cash flow in the quarter.

Road to Excellence

In 2018, we initiated a major five-year journey, ‘Road to Excellence’, to continue to transform at a fast pace, achieve unequalled customer satisfaction and achieve organizational excellence. To achieve this, we constantly focus on enhancing our capabilities by lean process improvements and building on our quality culture. As part of this journey, we have introduced Project Horizon. This company-wide project includes a significant number of cross-company opportunities that will further strengthen our execution capabilities and is expected to drive topline growth, enhance operational efficiencies, and free up working capital between now and the end of 2020.

Second quarter

Performance in the second quarter reflects a more challenging macro environment. Comparable sales growth of our growing profit engines was -2.3%. We experienced a lower level of market activity, most notably in Europe and were impacted by non-recurring country-specific developments in Saudi Arabia and India in Professional. Our growth platforms, connected systems, IoT platform services, horticulture, solar, and LiFi, show solid momentum. The Adjusted EBITA margin of the growing profit engines improved by 200 bps to 8.5%, with all three business groups contributing to this improvement.

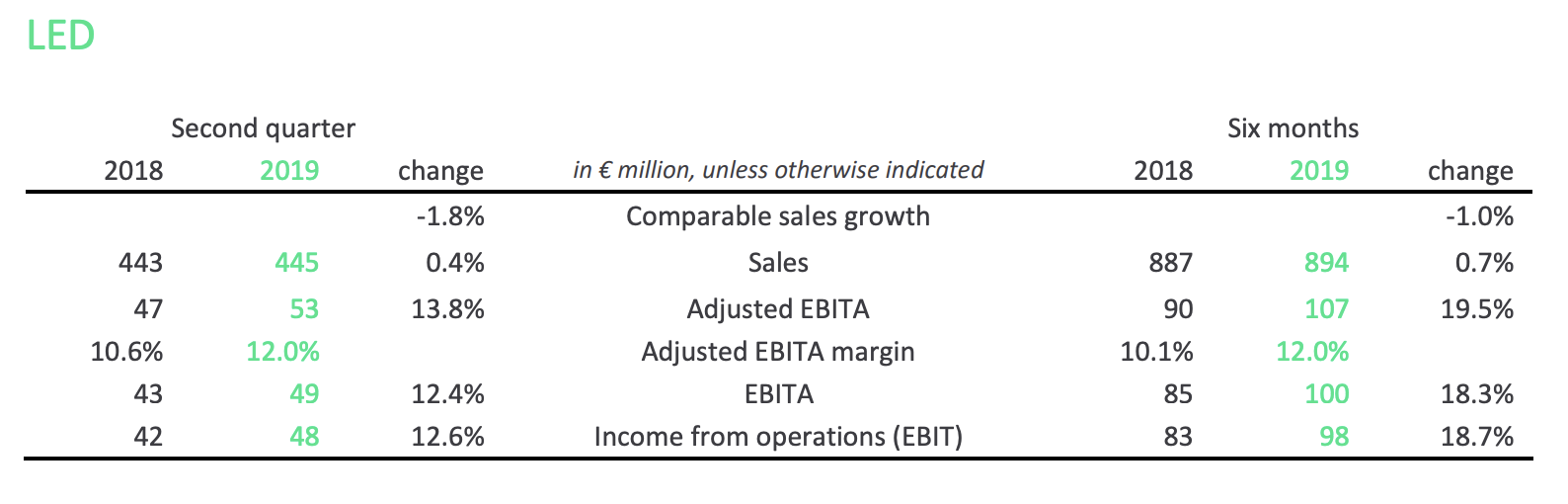

Second quarter

Sales amounted to EUR 445 million, a decrease of 1.8% on a comparable basis. LED lamps delivered a solid performance while sales in LED electronics continued to be impacted by lower customer demand, most notably in Europe. Adjusted EBITA increased by 13.8% to EUR 53 million, mainly driven by ongoing procurement savings and lower indirect costs. This resulted in an Adjusted EBITA margin improvement of 140 bps to 12.0%.

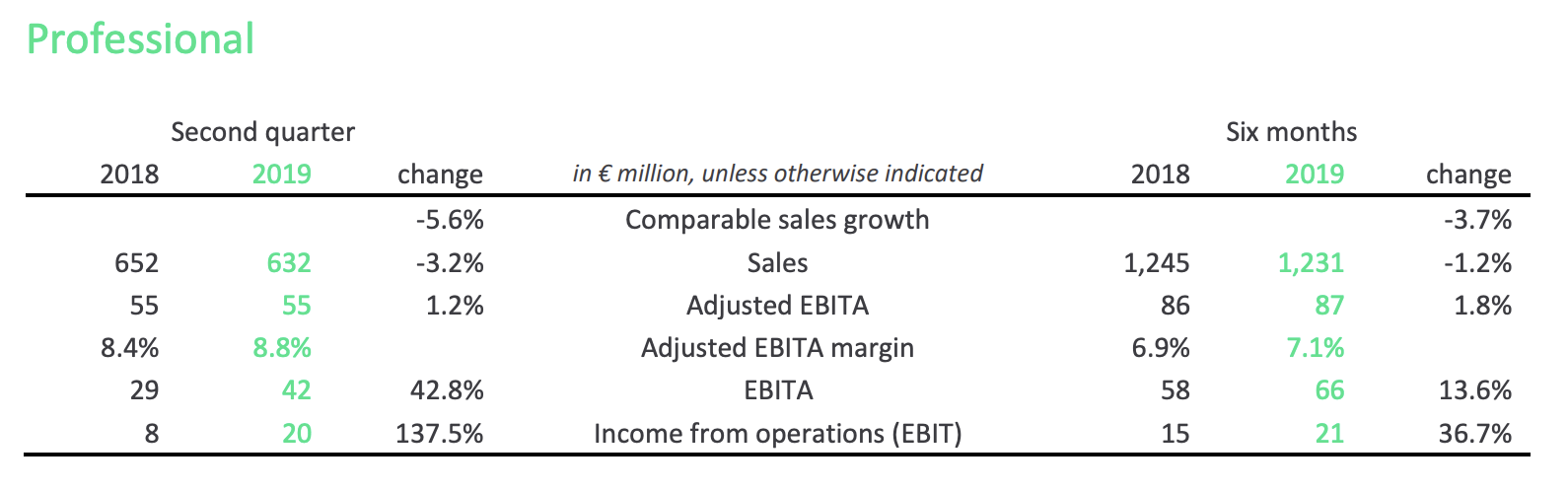

Second quarter

Comparable sales decreased by 5.6% to EUR 632 million, due to a lower level of market activity in Europe, and the temporary impact of SASO product re-certification in Saudi Arabia and elections in India. We experienced softening demand for public & outdoor projects, most notably in Europe, while the Americas and China had a robust performance. We have a solid order backlog and project pipeline for the second half of 2019, most notably in the Middle East and in façade lighting in China. Adjusted EBITA amounted to EUR 55 million, which resulted in an improvement in the Adjusted EBITA margin of 40 bps to 8.8% as procurement and indirect cost savings more than offset the negative impact of price and mix.

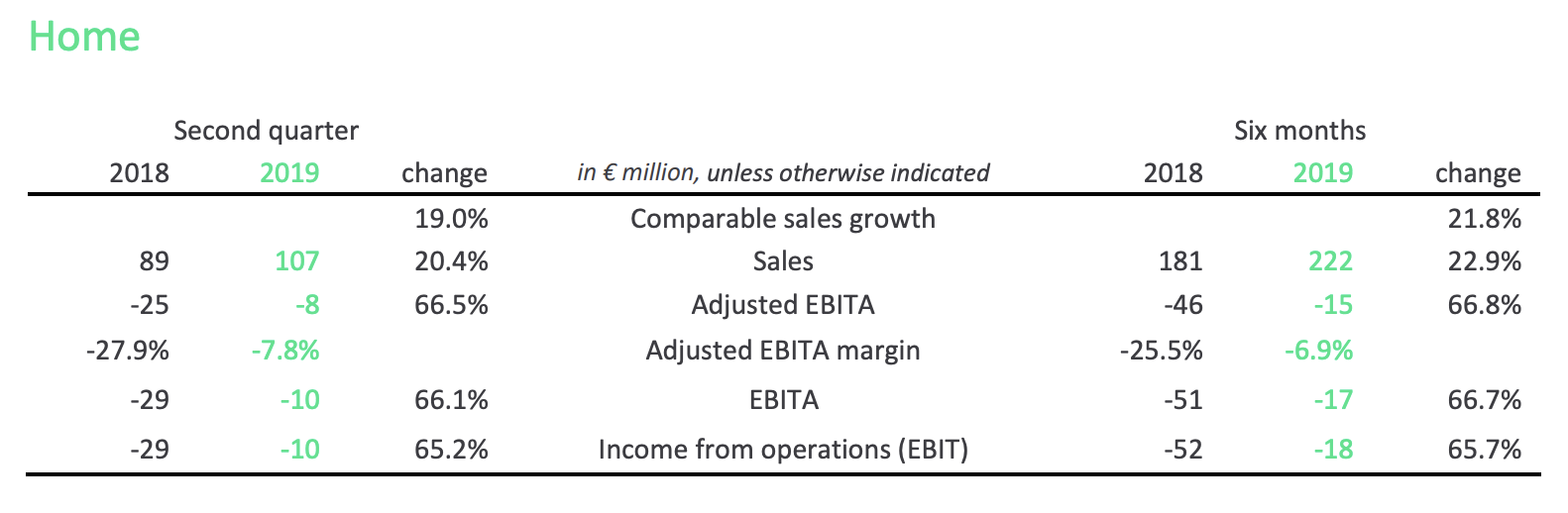

Second quarter

Sales amounted to EUR 107 million, an increase of 19.0% on a comparable basis, on the back of a strong performance in Europe as we continued to experience robust demand for connected offers. Adjusted EBITA increased by EUR 17 million to EUR -8 million thereby improving the Adjusted EBITA margin from -27.9% to -7.8%.

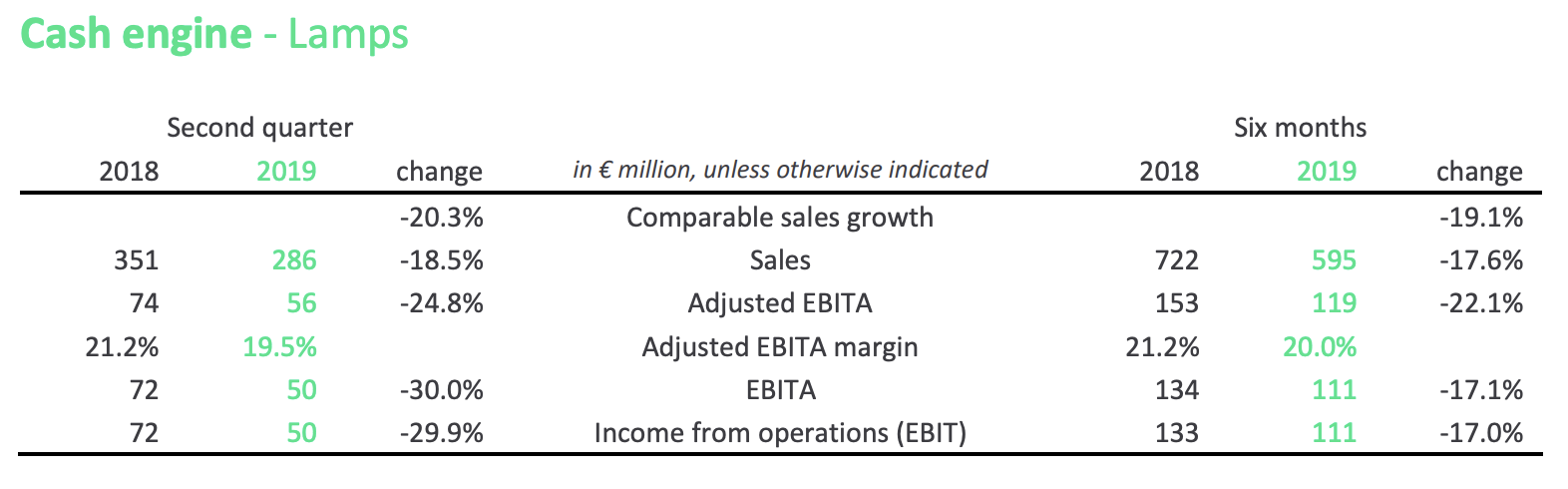

Second quarter

Sales amounted to EUR 286 million, a comparable decrease of 20.3%. Our cash engine continues to deliver on its ‘last man standing’ strategy, which resulted in further market share gains and solid free cash flow generation. The Adjusted EBITA margin remained robust at 19.5%.

OTHER

Second quarter

Other represents amounts not allocated to the operating segments and includes certain costs related to central R&D activities to drive innovation as well as group enabling functions. Adjusted EBITA amounted to EUR -24 million (Q2 18: EUR -21 million). EBITA amounted to EUR -27 million (Q2 18: EUR -38 million), including restructuring costs of EUR 3 million (Q2 18: EUR 8 million). There were no other incidental items that were not part of the Adjusted EBITA this quarter (Q2 18: EUR 9 million, mainly related to the company name change).

Second quarter

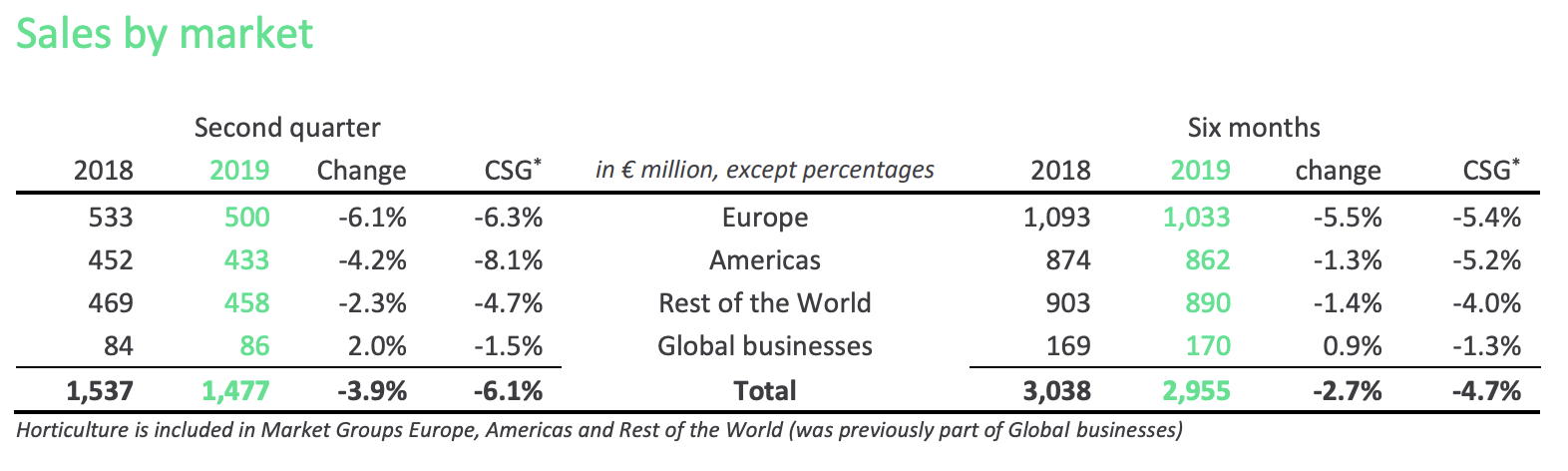

Comparable sales in Europe decreased by 6.3%, mainly reflecting challenging market conditions in Germany, Italy and France. Comparable sales in the Americas decreased by 8.1%, mainly driven by the ongoing decline of conventional and lower demand in the consumer channel of LED lamps. In the Rest of the World, comparable sales decreased by – 4.7%, with a solid performance in China and Indonesia offset by Saudi Arabia and India.

Second quarter

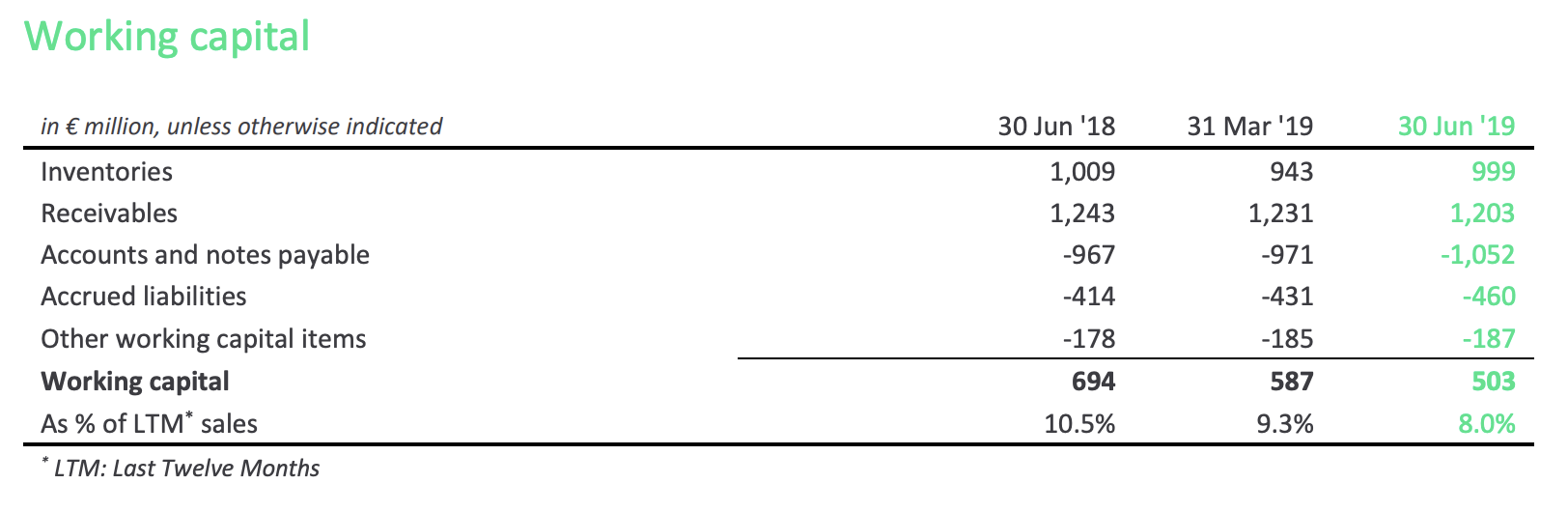

Working capital decreased by EUR 191 million to EUR 503 million and by 250 basis points to 8.0% as a percentage of sales, compared with the end of June 2018, including the above-mentioned phasing of payables and receivables. This performance reflects the company’s continued focus on improving working capital.

Second quarter

Free cash flow amounted to EUR 121 million, including a positive impact of EUR 17 million related to IFRS 16, compared with EUR -31 million in the same period last year. The increase in free cash flow is mainly driven by a reduction in working capital, which included the above-mentioned phasing of payables and receivables. The effect of phasing is estimated to represent around half of the free cash flow in the quarter. Free cash flow also included a lower restructuring pay-out of EUR 27 million (Q2 18: EUR 33 million).

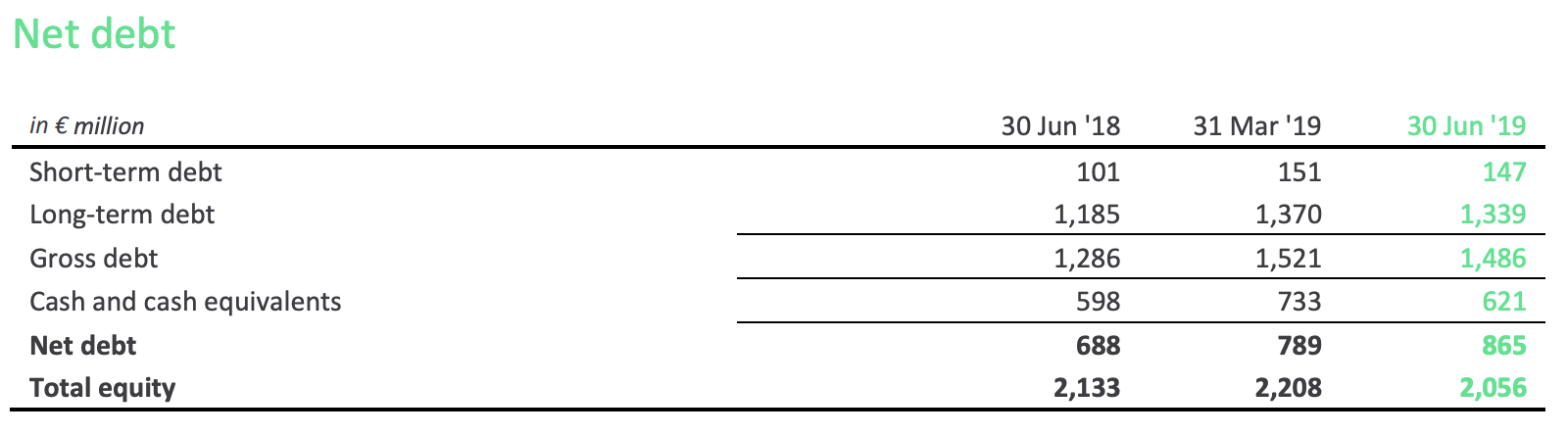

Second quarter

Net debt amounted to EUR 865 million, an increase of EUR 76 million compared with the end of March 2019 mainly due to dividend distribution of EUR 164 million which was partly offset by strong free cash flow generation. Total equity decreased to EUR 2,056 million at the end of Q2 19 (end of March 2019: EUR 2,208 million), primarily due to dividend distribution and currency translation results, partly offset by net income.