MANITOWOC, Wis. — Orion Energy Systems, Inc. (Orion Lighting) today reported results for its fiscal 2022 third quarter (Q3’22) and nine months (9M’22) ended December 31, 2021.

MANITOWOC, Wis. — Orion Energy Systems, Inc. (Orion Lighting) today reported results for its fiscal 2022 third quarter (Q3’22) and nine months (9M’22) ended December 31, 2021.

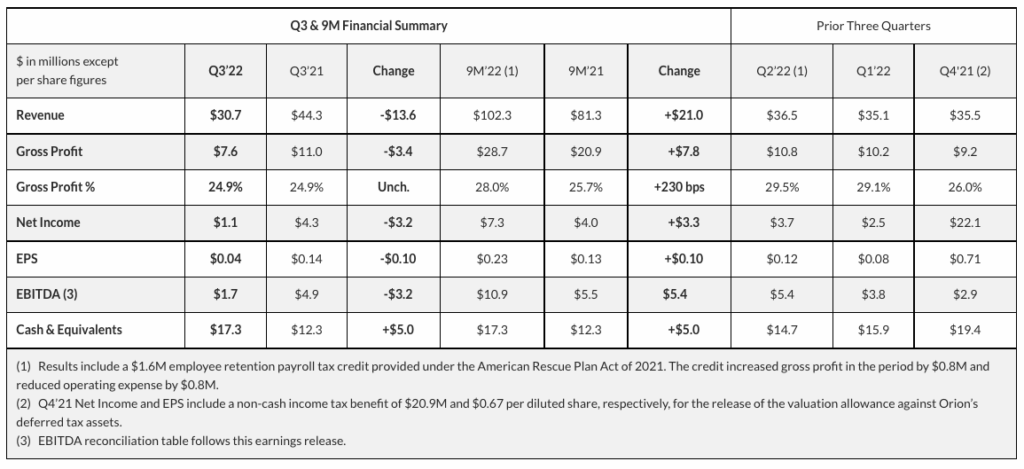

As anticipated, Orion reported Q3’22 revenue of $30.7M versus Q3’21 revenue of $44.3M, reflecting anticipated year-over-year reductions in project activity principally related to the Company’s largest customer, as well as the impact in the current period of customer delays on several larger LED lighting and controls projects. Delays in the quarter were primarily caused by the response of customers to supply chain disruptions and COVID-19 related impacts to their businesses. Revenue for the first nine months of FY 2022 increased to $102.3M versus $81.3M in the year-ago period.

CEO Commentary

Mike Altschaefl, Orion’s CEO and Board Chair, commented, “As we indicated last month, our FY 2022 performance is being impacted by customer delays on several larger LED lighting and controls projects, primarily caused by the response of customers to supply chain disruptions and COVID-19 related impacts to their businesses. Nonetheless, the Orion team has delivered improved year-to-date results, both on the top and bottom line, and remains on track to achieve double digit revenue growth in FY 2022. We continue to see significant long-term growth opportunities with current and prospective major national accounts.

“To expand the scope and growth potential of our newly launched Orion Maintenance Services business, in early January we acquired Stay-Lite Lighting, a nationwide lighting and electrical maintenance provider. With the addition of Stay-Lite, we have created a solid nationwide lighting and electrical maintenance service platform that complements our LED lighting capabilities, while providing a growing base of recurring services revenue. We believe this business should generate revenue in excess of $20M in our maintenance services business FY 2023.

“Our revenue growth during the first nine months includes some bright spots. Importantly, $12.0M of the growth in revenues, or 57.5%, came from customers excluding our largest customer. In addition, our ESCO business grew $7.2M, or 91.5%, and our Distribution business grew $2.2M, or 13.7%, demonstrating growing strength in those segments.

“Orion generated $10.9M in EBITDA through the first nine months of FY 2022, nearly double the level achieved last year, and we are well funded to support our growth goals. While business and economic uncertainties related to supply chain and COVID-19 issues are expected to impact customer project timelines in the near term, we remain confident in our competitive position and in our long-term growth potential. Moreover, as a domestic manufacturer of LED lighting fixtures, we are well-positioned to respond quickly to customer needs, particularly compared to competitors who have been experiencing challenges and delays in sourcing fixtures from Asia.”

Business Outlook

Given the current pace of large-customer activity, Orion anticipates FY 2022 revenue of approximately $130M, representing growth of 11% over revenue of $116.8M in FY 2021. Long-term, Orion’s Board and management team are committed to and confident in achieving the Company’s strategic plan which seeks to grow the business, via organic and external growth initiatives, into a $500M annual revenue business over approximately five years. Orion’s strategic plan envisions organic growth averaging at least 10% per year, augmented by external growth, including strategic acquisitions, business partnerships and other initiatives.

Orion cautions investors that its business outlook is subject to a range of factors that are difficult to predict, including but not limited to supply chain disruptions, shipping and logistics issues, component availability, rising input costs, labor supply challenges, the COVID-19 pandemic, and other potential business and economic impacts.

Financial Results

As previously announced, Orion’s Q3’22 revenue decreased to $30.7M from $44.3M in Q3’21, a period that had benefitted from a rapid rebound in major account activity, primarily with Orion’s largest customer, following initial COVID-19-related project disruptions. Revenue through the first nine months of FY 2022 increased $21.0M or 25.8% to $102.3M, compared to the first nine months of FY 2021 which were more impacted by COVID-19 disruptions.

Gross profit declined to $7.6M in Q3’22, as compared to $11.0M in Q3’21, due to lower business volume, however gross profit percentage remained steady at 24.9% in both periods. Orion’s 9M’22 gross profit increased to $28.7M versus $20.9M in 9M’21, reflecting an improved gross profit percentage of 28.0% versus 25.7% in the year ago period, due to higher revenue, an improved revenue mix and active supply chain, product and cost management.

Total operating expenses decreased to $6.3M in Q3’22 vs. $6.5M in Q3’21, benefitting from lower compensation costs which were partially offset by acquisition related costs of $0.2M.

Q3’22 net income decreased to $1.1M, or $0.04 per share, as compared to Q3’21 net income of $4.3M, or $0.14 per share, primarily due to lower revenue. Q3’22 net income included an income tax provision of $0.2M, though the Company does not expect to pay meaningful cash taxes due to significant net operating loss carryforwards of approximately $69M as of March 31, 2021.

Net income improved to $7.3M, or $0.23 per share, in the first nine months of FY 2022, from $4.0M, or $0.13 per share, in the first nine months of FY 2021. The year-to-date improvement principally reflects higher revenue and related operating leverage benefits.

Orion generated EBITDA of $1.7M in Q3’22 and $10.9M in 9M’22, compared to EBITDA of $4.9M in Q3’21 and $5.5M in 9M’21.

Cash Flow & Balance Sheet

Orion generated $6.3M of cash from operating activities in Q3’22, as compared to $8.5M in Q3’21. The decrease was primarily attributable to lower earnings, partially offset by working capital management.

Orion ended Q3’22 with over $41M of liquidity, including $17.3M of cash and cash equivalents and $24M of availability on its credit facility. The Company funded its acquisition of Stay-Lite Lighting, Inc. on December 31, 2021. That funding is included in Other long-term assets in the accompanying balance sheet.

Orion’s net working capital balance improved to $32.0M at December 31, 2021, as compared to $26.2M at its fiscal year-end March 31, 2021 and $23.3M at December 31, 2020.

Tagged with financial results, lightED, Orion