MANITOWOC, Wis. — Orion Energy Systems, Inc. (Orion Lighting) reported results for its fiscal 2022 first quarter (Q1’22).

MANITOWOC, Wis. — Orion Energy Systems, Inc. (Orion Lighting) reported results for its fiscal 2022 first quarter (Q1’22).

CEO Commentary

Mike Altschaefl, Orion’s CEO and Board Chair, commented, “As anticipated, the Orion team achieved a strong start to fiscal 2022 with solid Q1’22 revenues and a particularly strong gross margin performance of 29.1%. Our margin improvement is attributable to a favorable product mix as well as active supply chain and inventory management. Our year-over-year comparisons are particularly favorable given the significant impact of the onset of the COVID-19 pandemic on customer project activity timing in the first quarter of last fiscal year. We are proud of the resiliency of our team and customer relationships which have enabled Orion’s business to rebound very quickly.

“Through long-term planning, advance component purchases, proactive supplier management and U.S. based manufacturing, Orion has been able to mitigate supply chain challenges that have been seen not only in our industry but also throughout much of the economy. Though these challenges remain an area of concern in the near term, we feel Orion is generally well positioned to achieve our production goals for the balance of the year, particularly given our active management of sourcing and inventory.

“Longer term, Orion remains focused on building our pipeline of future projects and opportunities. Despite general economic and supply chain uncertainties throughout the economy, we are seeing slow but steady signs of customers reengaging on large-scale, national LED lighting projects for both new and retrofit opportunities. While these projects develop slowly, national customers recognize the value of Orion’s innovative, energy efficient products and our proven track record executing customized, turnkey project solutions with strong customer service and one centralized point of contact. Areas of opportunity include retail, logistics, healthcare, the U.S. public sector, including the U.S. Postal Service, the Military, and the academic sector.

“We continue to see strong and developing interest in new product offerings, including our ISON PureMotion™ line of airflow solutions for healthier indoor spaces. We are also engaged in several significant customer discussions related to our newly launched lighting and electrical maintenance services business. This traction underscores our confidence that this recurring revenue model business can begin to make a meaningful and growing contribution to Orion as the year progresses, and into future years.

“Importantly, Orion ended the quarter with $29.4M in net working capital, including $15.9M of cash, in addition to $25M available under our credit facility. We believe our strong financial footing positions us well for both organic and other potential growth opportunities.”

Business Outlook

Orion continues to expect FY 2022 revenue of $150M to $155M, representing growth of at least 28% over FY 2021. This outlook is supported by a diverse and growing base of opportunities across the business, with particular strength from customers in logistics; global online and national retailers; the public sector; healthcare and hospitals; academic institutions; automotive; and the Company’s developing maintenance services business.

Orion cautions investors that its business outlook is subject to a range of factors that are difficult to predict, including but not limited to the COVID-19 pandemic, supply chain disruptions, rising input costs, personnel recruitment challenges and other potential business and economic impacts.

Tax Provision

As a result of the valuation allowance release at the close of FY 2021, Orion’s Q1’22 financial results reflect a tax provision with a more normalized effective rate, in accordance with GAAP. Orion expects its financial results to reflect a similar GAAP tax provision in future periods. However, based upon current tax laws and the Company’s federal net operating loss carryforwards of approximately $69M at March 31, 2021, Orion does not expect to pay meaningful cash taxes for several years.

Financial Results

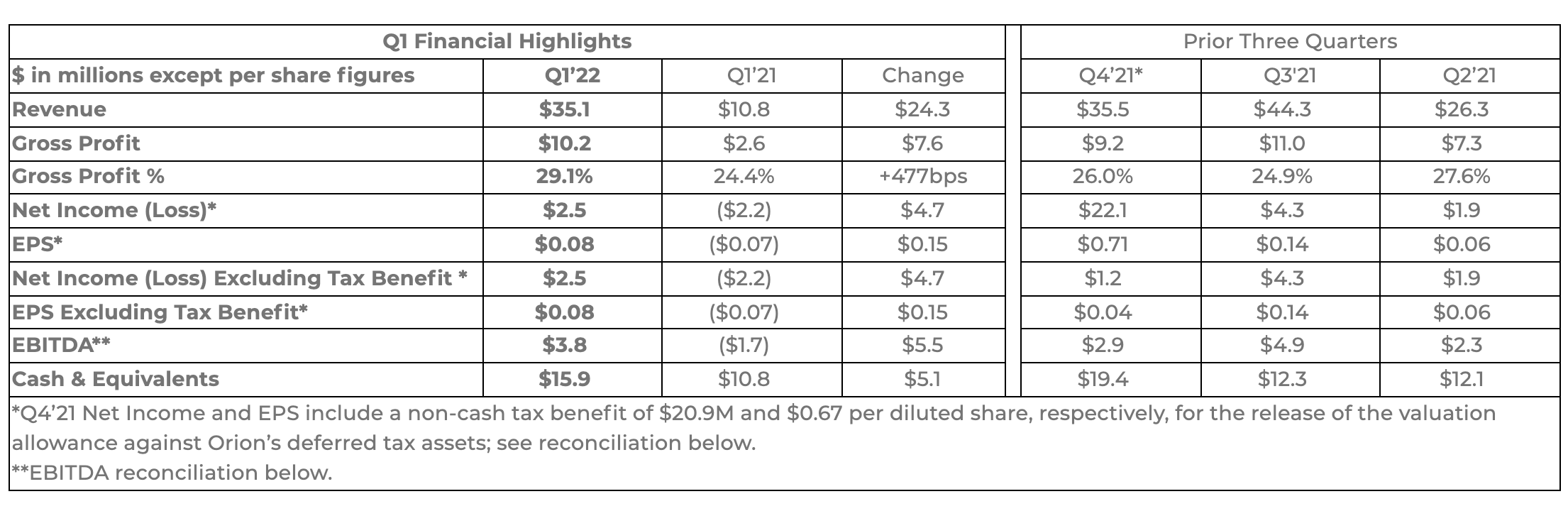

Orion’s Q1’22 revenue rose 225% or $24.3M to $35.1M from $10.8M in Q1’21, due to strong business activity, including national account retrofit projects, versus the operating environment in Q1’21, which included COVID-19 related disruptions that had halted many projects. Q1’22 benefitted from several large national projects, including for a large national retail customer and a global online retailer.

Gross profit percentage increased 477 bps to 29.1% in Q1’22 from 24.4% in Q1’21, due to a favorable product mix and the benefit of greater revenue absorbing certain fixed costs, as well as our proactive management of supply chain and input costs, which more than offset increases in raw material and component prices.

Total operating expenses were $6.8M in Q1’22 vs. $4.7M in Q1’21, primarily due to the higher level of business volume. As a percentage of sales, operating expenses declined to 19.4% from 43.3%.

Q1’22 net income improved to $2.5M from a loss of ($2.2M) in Q1’21. Q1’22 net income included income tax provision of $0.9M, though the company does not expect to pay meaningful cash taxes due its significant tax assets, which included net operating loss carryforwards of $69.4 million for federal tax purposes, as of March 31, 2021. Orion generated EBITDA of $3.8M in Q1’22 versus an EBITDA loss of ($1.7M) in Q1’21, as revenue and gross profit growth outpaced operating expenses.

Cash Flow & Balance Sheet

Orion used $3.0M of cash in operating activities in Q1’22, as compared to $7.7M in Q1’21. The improvement is attributable to higher net income, as Orion made similar levels of working capital investment in Q1 of both periods.

Orion ended Q1’22 with over $40M of liquidity, including $15.9M of cash and cash equivalents and a full $25M available on its $25M credit facility. Including cash and cash equivalents, Orion’s net working capital balance was $29.4M, as compared to $26.2M at March 31, 2021.

Tagged with financial results, lightED, Orion