PREMSTAETTEN, Austria and MUNICH, Germany — ams OSRAM reported positive first quarter group financial results. “Our business continued to perform well in the first quarter where we delivered results above the midpoint of our guidance range. As supply chain and end market imbalances remain a key influence, our automotive and industrial & medical businesses showed a very positive performance and our consumer business provided a strong contribution fully matching expectations”, said Alexander Everke, CEO of ams OSRAM, commenting on the first quarter.

PREMSTAETTEN, Austria and MUNICH, Germany — ams OSRAM reported positive first quarter group financial results. “Our business continued to perform well in the first quarter where we delivered results above the midpoint of our guidance range. As supply chain and end market imbalances remain a key influence, our automotive and industrial & medical businesses showed a very positive performance and our consumer business provided a strong contribution fully matching expectations”, said Alexander Everke, CEO of ams OSRAM, commenting on the first quarter.

“Our programs for integration and synergy creation are fully on track and I am pleased to see the positive momentum they are creating for our business. As part of these plans, we continue to move ahead in re-aligning our business portfolio. In the quarter we already announced the disposal of the automotive lighting systems business AMLS which was established following the dissolution of the OSRAM Continental joint venture in the fourth quarter 2021. In addition, we just closed the disposal of the horticulture lighting systems business Fluence as expected. We are now focused on implementing the remaining portfolio re-alignments and disposals as communicated,” Everke added.

“Tightness in chip supply and imbalances in multiple supply chains remain at the center of developments in our markets and are not restricted to the automotive market. In light of this situation our business demonstrated a robust operational performance in the quarter. We do not expect these imbalances to be resolved quickly, while recent additional end market volatility and global market uncertainties are adding to a demanding environment going forward.

At our recent Capital Markets Day, we laid out a strong model for mid- and long-term profitable growth which we expect to deliver through a range of attractive growth drivers across end markets. We are keen to move forward on these opportunities through focused investments into our technology portfolio for visualization, illumination, and sensing as well as into industry-leading manufacturing capabilities. This innovation platform will enable us to drive profitability and differentiation to create long-term value in optical solutions,” Everke concluded.

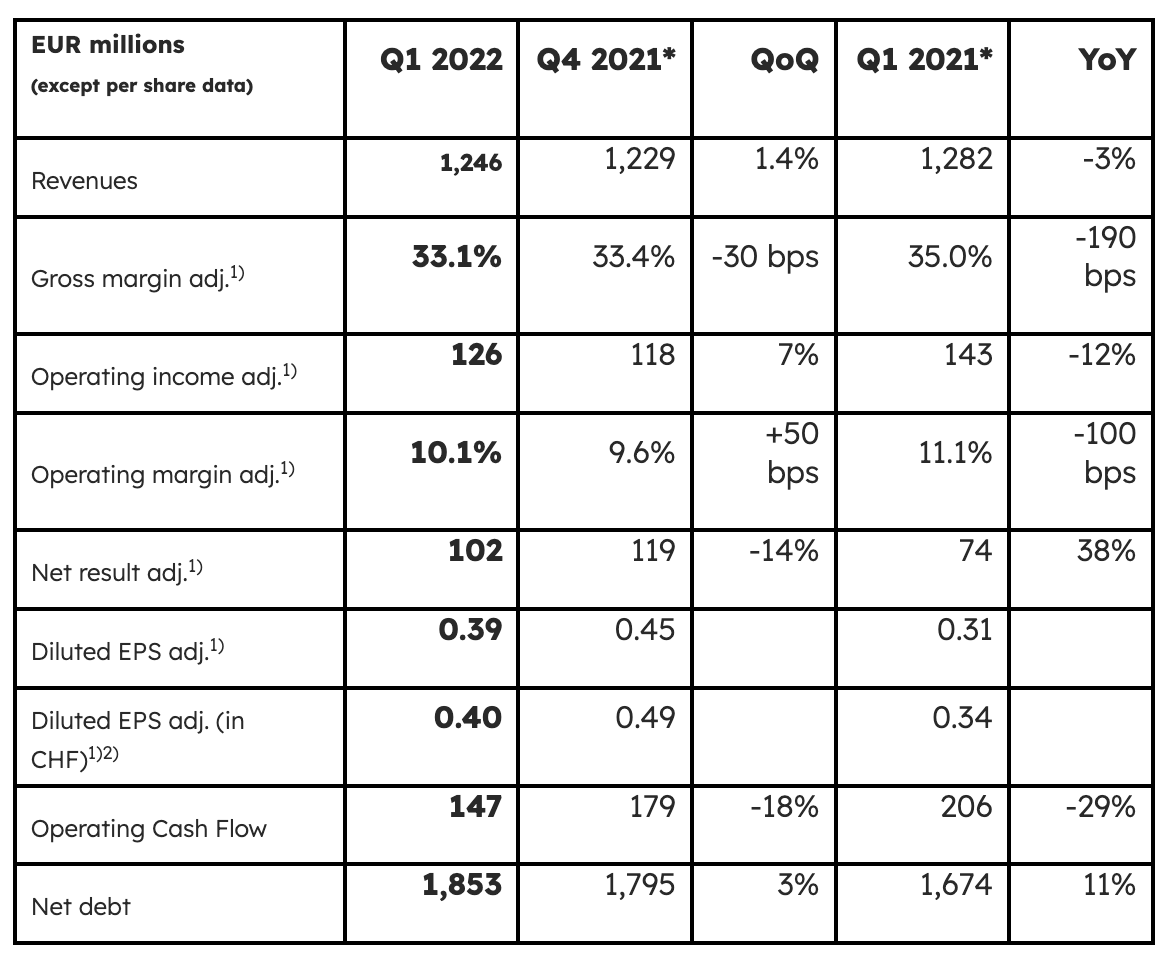

Quarterly financial summary

1) Excluding M&A-related, transformation and share-based compensation costs as well as results from investments in associates and sale of a business

2) Earnings per share in CHF were converted using the average currency exchange rate for the respective periods

* 2021 financials reflect reclassification within functional cost categories

Note: EPS denotes earnings per share

First quarter group revenues were EUR 1,246 million, up 1% sequentially compared to the fourth quarter 2021 and down 3% compared to same quarter 2021 (first quarter 2022 USD 1,394 million). Adjusted[1] group gross margin for the first quarter 2022 was 33%, unchanged from the fourth quarter and down from 35% for the same quarter 2021. The first quarter adjusted1 group result from operations (EBIT) was EUR 126 million or 10% of revenues compared to EUR 118 million or 10% for the fourth quarter and EUR 143 million or 11% of revenues for the same period 2021 (unadjusted: EUR 40 million or 3% of revenues for the first quarter).

First quarter adjusted1 group net result was EUR 102 million compared to EUR 119 million for the fourth quarter and EUR 74 million for the same quarter 2021 (unadjusted: EUR 15 million for the first quarter). First quarter adjusted1 diluted earnings per share[2] were EUR 0.39 or CHF 0.40 (EUR 0.06 or CHF 0.06 unadjusted). First quarter group operating cash flow was EUR 147 million while group free cash flow reached EUR 34 million. Group net debt was EUR 1,853 million on 31 March 2022, translating into a group leverage of 2.0x net debt/adjusted1 EBITDA. Cash and cash equivalents stood at EUR 1,235 million on 31 March 2022.

The group’s Semiconductors segment contributed strongly to group performance again, generating 63% of revenues in the first quarter of 2022 at a healthy adjusted operating margin of 13%. The segment’s automotive market area recorded very positive results driven by available backlog in a market environment which remains characterized by end-to-end supply imbalances and reduced production volumes. The consumer market area showed a robust performance that was fully in line with expectations and reflected seasonal effects together with sequentially lower global smartphone shipments and a volatile demand environment. This performance continued to be driven by optical sensing solutions that power a range of applications across multiple device types and consumer market segments. The industrial and medical market area contributed very attractively to group results given positive demand momentum for advanced LED lighting in established and emerging markets and a supportive contribution from industrial and medical imaging.

As presented at the recent Capital Markets Day, ams OSRAM follows a clear strategy for growth through optical innovations. The group’s R&D investments and product developments focus on growth opportunities including consumer and automotive light sensing, 3D technologies for world-facing camera applications, AR/VR applications, display management, horticulture and UV-C LED solutions, advanced automotive LED front lighting, and LED technology to create micro-LED displays.

The Lamps & Systems (L&S) segment showed an overall positive performance in the first quarter contributing 37% of revenues. The L&S automotive business including legacy traditional lighting continued to positively track expectations as results reflect seasonal effects and good overall demand. The other areas of the L&S business provided solid contributions from their diversified range of industrial, building-related and medical applications in a generally supportive demand environment.

For the second quarter 2022, ams OSRAM expects group revenues of EUR 1,150-1,250 million (EUR 1,180-1,280 million on a comparable portfolio basis) and an expected adjusted operating (EBIT) margin of 8-11%, based on currently available information and exchange rates. This includes a revenue deconsolidation effect for the second quarter reflecting the closing of the disposal of the horticulture lighting systems business Fluence which reduces expected second quarter revenues by approx. EUR 30 million on a comparable portfolio basis. Expectations for the second quarter mirror the continued demanding market environment in the automotive industry where constrained supply chain situations and ongoing volatility continue to impact production volumes across regions. The expectations for the second quarter also reflect the current volatile demand development in the consumer market, a decreased year-on-year contribution from the consumer market in line with previous comments, and deconsolidation effects when compared to the previous year.

Tagged with ams OSRAM, financial results, lightED