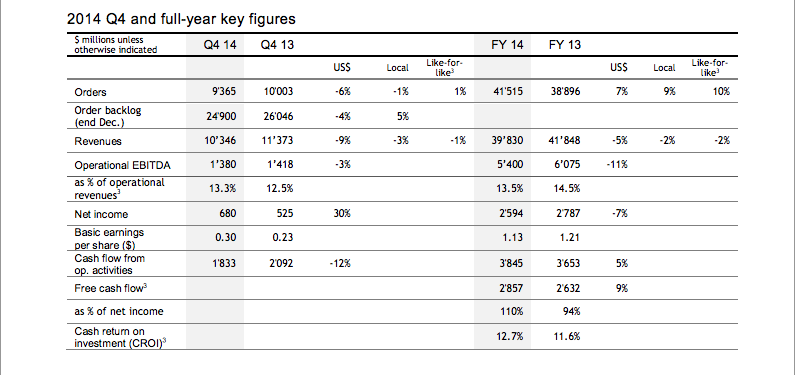

Full-year summary:

- ABB delivers 10% order growth to $41.5 bn on focused growth initiatives

- Base orders up 5%, large orders up 50%, positive book-to-bill at 1.04x

- Power Systems (PS) and lower opening order backlog impacted revenues of $39.8 bn

- PS at breakeven operational EBITDA, comparable operational EBITDA margins in other divisions steady

- 6th consecutive year of +$1 bn in cost savings

- Net income at $2.6 bn, operational EPS $1.28, basic EPS $1.13

- Free cash flow up 9%, conversion rate up to 110%; cash return on investment 12.7%, up 110 basis pts

- Portfolio pruning generated more than $1 bn in pre-tax proceeds

- Board proposes 6th consecutive dividend increase to CHF 0.72 per share

- Next Level strategy well under way to accelerate sustainable value creation

Q4 summary:

- 6th consecutive quarter of base order growth, total orders steady at $9.4 bn

- Solid progress on PS turnaround, 2.4% operational EBITDA margin

- Net income up to $680 mn, operational EPS $0.34, basic EPS $0.30

- Cash from operations reflects more balanced cash generation over the year

- Partnership with Hitachi on HVDC technology for Japan

- Foundation for Next Level in place: Market-focused organization implemented, top 1,000 positions filled, performance-based compensation model finalized

- Peter Voser proposed as new Chairman of the Board

“2014 was a demanding year where we had to overcome the challenges of Power Systems and a low order backlog,” said CEO Ulrich Spiesshofer. “We delivered on our ambition to achieve full-year profitability in Power Systems and took decisive actions to drive organic growth, cost-out and cash generation.

“Our solid progress on the Next Level strategy puts us in a strong position to manage the global uncertainties heading into 2015. Our proposal to increase the dividend for the sixth consecutive year demonstrates our commitment to long-term sustainable value creation.”

Full-year 2014 results

ABB continued to drive its organic growth initiatives in 2014 and delivered 9-percent order growth (10 percent like-for-like). Orders were steady to higher in all regions and divisions despite a challenging market environment. Large orders (above $15 million) grew 50 percent. Base orders were 4 percent higher (5 percent like-for-like) and grew in each quarter of the year. The order backlog grew 5 percent and the book-to-bill ratio improved to 1.04x from 0.93x compared to the end of 2013.

“Through our organic growth initiatives and continued focused investments in innovation and sales, we grew orders faster than the market in a highly volatile environment,” said CEO Ulrich Spiesshofer. “This resulted in a stronger order backlog heading into 2015. Our customer satisfaction score NPS again went up, to 44, reflecting that our customers appreciate the many efforts we take in improving customer service every day.”

Revenues and operational EBITDA were lower due to the lower opening order backlog and project-related charges in Power Systems, but strong business execution resulted in higher full-year operating cash flow generation. Successful implementation of the ‘step change’ program to reposition the Power Systems division for a return to long-term consistent growth and profitability resulted in a full-year break-even operational EBITDA for the division. The operational EBITDA margin in the Discrete Automation and Motion division was impacted by the dilutive effect of the Power-One acquisition completed in the second half of 2013. Excluding that effect, the comparable operational EBITDA margin was slightly higher.

“We delivered on our ambition to achieve a break even result for Power Systems for the full year,” Spiesshofer continued. “The other divisions all generated steady comparable margins. We improved cash generation, and for the 6th consecutive year took out more than $1 billion in costs which shows that our relentless execution focus is really paying off.”

Net income was $2.6 billion and basic earnings per share was $1.13. Successful measures to improve net working capital management contributed to higher cash from operations and free cash flow conversion3 and supported an increased cash return on investment (CROI) of 12.7 percent.

In 2014, the company returned more than $2.8 billion in cash to shareholders through share repurchases and the annual dividend. For 2014, the Board has proposed a dividend increase to 0.72 Swiss francs compared to 0.70 Swiss francs for the previous year. The proposal is subject to approval by shareholders at the company’s annual general meeting on April 30, 2015.

Q4 2014 results

ABB’s order pattern in its three major customer sectors remained largely unchanged in the quarter. Utilities continued to be cautious in capital expenditures in response to regulatory uncertainties in Europe and lower electricity consumption related to GDP growth in most other regions. However, they continued to make selective investments in power transmission to link grids and to integrate renewable power sources. Demand from industrial customers varied widely by sector and region. Overall, industrial demand for both power and automation solutions to improve the productivity and efficiency of existing assets remained steady. Demand in the upstream oil and gas sector remained strong and the potential impact of lower oil prices was not visible in the quarterly results. Demand in the mining sector remained at low levels. The strong automation growth trajectory seen in the automotive sector in recent years continued in 2014, driven by a combination of new model introductions, innovations in robot technologies and regional expansion. The ongoing need to improve the efficiency of rail and marine transportation benefited both the power and automation businesses in the quarter, while construction markets were mixed.

Total orders received in the quarter were stable (up 1 percent on a like-for-like basis). The appreciation of the US dollar in Q4 2014 versus the prior year period resulted in a negative translation impact on orders of 5 percent and on revenues of 6 percent.

Base orders increased for the sixth consecutive quarter and were up 2 percent (4 percent like-for-like), supported by growth initiatives across many businesses, products and geographies. Base orders grew in the two power divisions, reflecting both positive demand from industry customers as well as initiatives in Power Systems to drive growth in base orders that are lower risk and have higher ABB value-added. Base order growth compensated the timing effect of lower large orders, which represented 11 percent of total orders received in the quarter, compared to 14 percent in the same quarter in 2013.

Service orders represented 18 percent of total orders.

Revenues declined 3 percent (down 1 percent like-for-like) in the fourth quarter. Higher like-for-like revenues in the company’s short-cycle businesses, especially in Low Voltage Products, were not sufficient to offset revenue decreases in the power divisions, where opening order backlogs were lower. Service revenues increased 6 percent (7 percent like-for-like) and reached 17 percent of total revenues, up from 16 percent in the same quarter a year earlier.

The order backlog at the end of December amounted to $25 billion, an increase of 5 percent in local currencies compared to the end of the same quarter in 2013.

Orders received and revenues by region:

Base orders were higher in all regions on a like-for-like basis in the fourth quarter, with timing-related decreases in large orders accounting for the order reduction in the Americas and the Middle East and Africa.

Growth in Europe was led by Sweden and Finland, driven mainly by orders in the rail and marine transportation sectors. Orders were also higher in France, Italy and Switzerland, while Germany was stable and eastern Europe was lower.

Orders were lower in the Americas, mainly reflecting a timing-related decline in large orders in the power businesses in the US and Canada compared with the same period the year before. Base orders increased in the region.

The large markets of China and India recorded higher orders in the fourth quarter, leading to a 6-percent increase in Asia (7 percent like-for-like). Orders also grew strongly in Japan.

Orders decreased in the Middle East and Africa, mainly the result of lower large orders in the oil and gas sector.

Starting in the first quarter of 2015, ABB will begin reporting regional growth in three regions: Europe, the Americas, and Asia, the Middle East and Africa.

Orders received and revenues by division:

Discrete Automation and Motion: Orders and revenues were steady in a mixed environment. Growth initiatives to sell packaged industrial services and solutions supported growth in the robotics and drives businesses in the quarter. Orders increased in Europe and were lower in Asia and the Americas. Higher service revenues compensated lower revenues in longer cycle businesses with lower opening order backlogs.

Low Voltage Products: Like-for-like orders increased in all businesses and were strongest in the Middle East and Africa and higher in the Americas, supported by successful initiatives to increase the sale of ABB products in the US through the Thomas & Betts distribution system. Order growth was steady in Europe and Asia. Like-forlike revenues were also higher.

Process Automation: Orders were steady at high levels in the quarter, with both large and base orders near the same levels as in the same period in 2013. The upstream oil and gas and marine sectors were stronger than mining and metals. Orders grew in the Americas and Europe and were steady in Asia. Orders declined in the Middle East and Africa as a large order taken in the same period in 2013 was not repeated. Revenues were also stable, as higher service revenues offset the lower opening order backlog in the systems business.

Power Products: Both large and base orders increased in most regions, supported by industrial demand as well as selective power transmission investments. Orders grew in all regions except Europe, driven by growth in emerging markets. The revenue decline in the quarter largely resulted from the lower opening order backlog.

Power Systems: An increase in base orders, reflecting in large part ongoing initiatives to reposition the business and focus on high value-added projects, was more than offset by a lower intake of large orders due to the timing of awards compared to the same quarter a year earlier. Revenues were lower than the previous year, impacted by the lower opening order backlog.

Earnings overview

Operational EBITDA

Lower revenues and a negative translation effect from the appreciation of the US dollar resulted in a 3-percent decline in operational EBITDA to $1.4 billion in the fourth quarter. The operational EBITDA margin increased. This was partly due to a positive operational EBITDA in the Power Systems division, which reported a loss in the same period in 2013 on charges related to operational performance. Cost savings of approximately $350 million and further productivity improvements more than offset price pressures in the quarter.

In line with the updated financial targets in the company’s Next Level strategy, ABB will change to reporting operational EBITA3 instead of operational EBITDA with its first quarter 2015 results.

Net income

Net income for the quarter increased to $680 million and included after-tax gains from the sale of businesses and charges for foreign exchange and commodity timing differences. Basic earnings per share amounted to $0.30 in the fourth quarter compared to $0.23 in the same quarter a year earlier.

Balance sheet and cash flow

Total debt at the end of the fourth quarter amounted to around $7.7 billion, compared with $8 billion at the end of 2013. Net debt3 at the end of the fourth quarter decreased to $923 million from $1.5 billion at the end of 2013 reflecting the strong cash flow from operations in 2014.

ABB reported cash from operations of $1.8 billion in the fourth quarter, a timing-related decrease of 12 percent compared with the same quarter in 2013. The decline is mainly the result of ongoing measures to better balance cash flows over the full year and reduce the historical trend of very high cash flows in the fourth quarter.

Discrete Automation and Motion: The operational EBITDA margin was steady, as cost and productivity measures offset weaker margins in the Power-One solar inverter business compared to the same quarter a year earlier.

Low Voltage Products: The improved operational EBITDA margin reflects a combination of positive product mix as well as continued success to reduce cost and increase productivity. Process Automation: The operational EBITDA margin remained steady compared to the same quarter a year earlier.

Power Products: Operational EBITDA and margin decreased compared with a high level a year ago, reflecting lower revenues, mix effects and increased investments in sales compared with the same quarter in 2013.

Power Systems: Operational EBITDA and margin improved as charges related to project delays and operational issues decreased significantly compared to the year-earlier period as a result of the success of ongoing measures to de-risk the business and focus on higher value-added projects.

Dividend and share buyback

ABB’s Board of Directors has proposed to increase the dividend for 2014 by 0.02 Swiss francs to 0.72 Swiss francs per share, compared with 0.70 Swiss francs per share in the prior year. The proposal is in line with the company’s dividend policy to pay a steadily rising, sustainable dividend over time.

If approved by shareholders at the company’s annual general meeting on April 30, 2015, the Board proposes that the dividend be paid in a tax efficient way in two tranches: one of 0.55 Swiss francs from ABB Ltd’s capital contribution reserve in May 2015 and the other of 0.17 Swiss francs from a reduction in the nominal (par) value of the ABB share from 1.03 Swiss francs to 0.86 Swiss francs in July, 2015. Both forms of payment would be exempt from Swiss withholding tax.

For the dividend paid from ABB’s capital contribution reserve, the ex-dividend date would be May 4, 2015 for American Depositary Shares traded on the New York Stock Exchange in the US, and May 5, 2015 for shares traded on the SIX Swiss Exchange and on the NASDAQ OMX exchange in Sweden. The payout dates would be May 7, 2015, for shares traded on the SIX Swiss Exchange, May 11 for shares traded on the NASDAQ OMX exchange in Sweden, and May 14 for American Depositary Shares traded on the New York Stock Exchange in the US.

For the dividend from the nominal value reduction, the ex-dividend and payout dates in Switzerland are expected in July 2015, in line with Swiss regulatory processes. Further information will be made available on ABB’s website in due course.

ABB announced a $4-billion share buyback program in September 2014. During the fourth quarter, ABB purchased approximately 17 million shares under the program with a buyback value of approximately $380 million. Since the program was announced, the company has purchased a total of approximately 33 million shares with a buyback value of approximately $730 million.

Divestitures and portfolio pruning

In the fourth quarter, ABB completed the divestiture of its Full Service business for an undisclosed amount. The divestment, which was announced in August 2014, is in line with ABB’s commitment to continuous portfolio optimization. In 2014, ABB raised more than $1 billion in pre-tax proceeds from divesting businesses that have no substantial synergies with the rest of the portfolio. Divestitures and other portfolio pruning activities in 2014 and 2013 reduced 2014 revenues by approximately $500 million compared with 2013.

Board changes

As announced in December, ABB Chairman Hubertus von Grünberg and Board member Michael Treschow have decided not to stand for re-election to the Board of Directors at the next annual general meeting.

Furthermore, the Board unanimously nominated Peter Voser to succeed von Grünberg as Chairman. Peter Voser was CEO of Royal Dutch Shell, one of the world’s largest companies, from 2009 until the end of 2013. From 2002 to 2004, Voser was CFO of ABB and a key leader behind the successful turnaround and repositioning of the company for long-term profitable growth. Voser also brings a wealth of experience as a Board member of publicly listed companies such as Roche, UBS and Aegon.

As previously announced, ABB’s Board of Directors has unanimously proposed David Constable as a new Board member. Constable is the President and CEO of Sasol Limited, a leading international integrated energy and chemicals company.

Shareholders will vote on both proposals at the company’s next annual general meeting on April 30, 2015.

Next Level strategy

In September, ABB announced its Next Level strategy and financial targets for the 2015-2020 period aimed at accelerating sustainable value creation from its leading power and automation portfolio. The strategy builds on the three focus areas of profitable growth, relentless execution and business-led collaboration.

The focus of profitable growth is to shift the company’s center of gravity towards greater competitiveness, higher organic growth and lower risk. ABB intends to drive organic growth through the PIE concept (penetration, innovation, expansion), further increase competitiveness in areas such as technology, service and software, and reduce intrinsic business risks by, for example, aligning business models more closely with ABB’s core competencies. Organic growth will be complemented by incremental strategic acquisitions and partnerships. The recently-announced partnership with Hitachi is an example of partnership-based expansion into new segments.

ABB has been successful in relentlessly executing its programs to reduce costs and improve customer service. The company intends to broaden those efforts by developing a leading operating model across ABB, starting with the areas of white-collar productivity, net working capital management, and quality. For 2015, the completion of the Power Systems ‘step change’ program will remain a high priority. Major Group-wide change Press Release ABB Group Q4 results 2014 Page 8 of 12 management will be implemented through 1,000-day programs that drive and coordinate change across all businesses and regions. The strategic objectives and targets have been explicitly linked to a new performance management and compensation model.

The main objectives of business-led collaboration are to increase focus on the company’s markets and customers and to simplify how the organization works together. To achieve this, ABB has streamlined its regional organization—reducing the number of regions from eight to three—with regional management on the Executive Committee to bring ABB closer to the market. At the same time, roles and responsibilities have been clarified—including giving global business lines undiluted responsibility for their businesses—and processes put in place to strengthen cross-business collaboration.

The base for successful implementation of the strategy has already been laid. The Next Level strategic direction and targets are defined, broken down to individual businesses and widely communicated and accepted. The new organization structure is in place, including the 1,000-day program office and the appointment of the top 1,000 leaders.

The Next Level strategy includes the following financial targets: ABB expects to grow operational earnings per share (EPS) at a 10-15 percent compound annual growth rate (CAGR) and deliver attractive cash return on investment (CROI) in the mid-teens over the period 2015-2020. It targets to grow revenues on a like-for-like basis on average 4-7 percent per year over six years, faster than forecasted GDP and market growth. Over the same time period, ABB plans to steadily increase its profitability, measured in operational EBITA, within a bandwidth of 11-16 percent while targeting an average free cash flow conversion rate above 90 percent. The new financial targets took effect on January 1, 2015. The margin target for Power Systems will be in effect as of January 1, 2016, after concluding the ‘step change’ program.

Outlook

The long-term demand outlook in ABB’s three major customer sectors—utilities, industry, and transport and infrastructure—remains clearly positive. Key drivers are the big shift in the electricity value chain, industrial productivity improvements and Industry 4.0, as well as rapid urbanization and the need for energy efficiency in transport and infrastructure.

ABB is well positioned to tap these opportunities for long-term profitable growth with its strong market presence, broad geographic and business scope, technology leadership and financial strength.

In the short term, macroeconomic and geopolitical developments are signaling a mixed picture with increased uncertainty. Some macroeconomic signs in the US remain positive and growth in China is expected to continue. At the same time, the market remains impacted by slow growth in Europe and geopolitical tensions in various parts of the world.

Oil prices and foreign exchange effects

Current oil prices will influence customer operating and capital expenditures along the oil and gas value chain, and influence spending by many other ABB customer segments and government spending in different ways. Government spending on energy subsidies may be reallocated to other infrastructure development and certain customer segments will benefit from lower energy costs. However, the current oil price will have a dampening effect on the oil and gas value chain, mainly in the upstream sector.

Currency volatility has increased over the last 12 months, including the weakening of the Euro against the US dollar and Swiss franc. Changes in foreign exchange rates have two effects on ABB’s financial results, Press Release ABB Group Q4 results 2014 Page 9 of 12 translational and structural. Translational impacts result from converting local-currency financial information from ABB companies around the world into US dollars at average exchange rates for the purpose of reporting results in US dollars. In the fourth quarter of 2014, the appreciation of the US dollar versus the same period in 2013 had a negative translation impact on orders of 5 percent and on revenues of 6 percent. If the exchange rate stays at current (February 2015) levels, ABB expects a negative translation effect to continue into 2015.

Structural effects are related to the export of products and services from one currency zone into another. ABB’s well-balanced local operations (including sourcing) in all key markets mean these structural effects have a limited impact. Further, its policy to actively hedge all significant foreign exchange exposures means these effects are largely mitigated in the short to medium term.

Tagged with lighting, tED